Performance

Ask yourself this question:

“How many services can recommend a short sale within a percent or two and day or two of an exact countertrend high, then cover and go long within those same parameters….. and then take profits again—all in less than six weeks?”

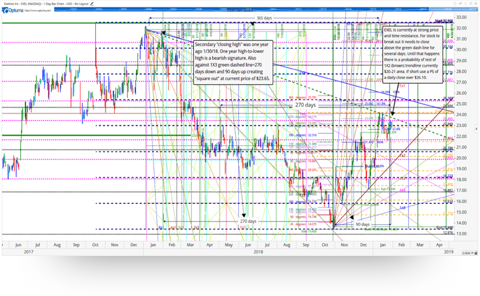

Exelixis, Inc. (EXEL)

The first biotech stock we tackled was EXEL recommending a short sale on Jan 24th and then again on Feb 7th

Click on the image to zoom

Click on the image to zoom

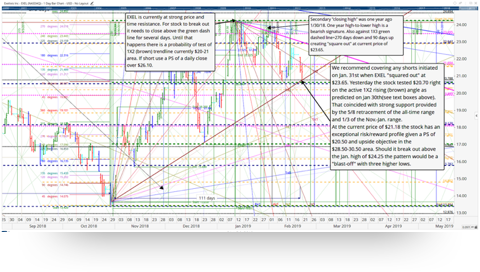

After calling two important tops in EXEL within a period of two weeks, the stock subsequently declined “as predicted” to the rising 1X2 angle where we recommended covering the short within a day and $0.50 of the exact low and going long (see graph below).

Click on the image to zoom

Click on the image to zoom

Over the next eighteen days the stock moved up into first resistance at the $25 level where we recommended taking profits of $3.77 or 17.8% in just three weeks.

Click on the image to zoom

Click on the image to zoom

For those who elected to short the stock “into strong resistance at the $25-26 level” they got another opportunity to take profits and go long on March 27th at virtually the exact low at the $23 level with an extremely tight stop risking just $0.25 per share.

Click on the image to zoom

Click on the image to zoom

Had one followed our recommendations on EXEL (explicit and implied) over the period 1/24/19 to 3/29/19 they could have taken out profits over $8 or 34% (shorts=$4.37 and longs=$3.77)

Previous: S&P Cash as…

Next:Bigoen (BIIB)